Unknown Facts About Personal Loans copyright

Unknown Facts About Personal Loans copyright

Blog Article

Personal Loans copyright Fundamentals Explained

Table of ContentsPersonal Loans copyright Can Be Fun For AnyoneThe Facts About Personal Loans copyright UncoveredThe 8-Minute Rule for Personal Loans copyrightHow Personal Loans copyright can Save You Time, Stress, and Money.How Personal Loans copyright can Save You Time, Stress, and Money.

When thinking about a personal financing, it's practical to understand just how much it may set you back. The yearly percent price (APR) on an individual lending stands for the annualized cost of paying off the financing based upon the rate of interest and charges. The APR and financing term can figure out just how much you pay in rate of interest overall over the life of the lending.The finance has a repayment regard to 24 months. Making use of those terms, your monthly payment would certainly be $450 and the total interest paid over the life of the finance would certainly be $799.90 (Personal Loans copyright). Currently assume you obtain the exact same amount yet with different lending terms. As opposed to a two-year term, you have 3 years to settle the loan, and your interest rate is 6% rather than 7.5%.

Comparing the numbers this way is very important if you intend to get the most affordable regular monthly repayment possible or pay the least amount of passion for an individual finance. Utilizing an easy on-line individual loan calculator can assist you identify what sort of settlement amount and rate of interest are the ideal fit for your spending plan.

What Does Personal Loans copyright Mean?

You can apply online, get a choice in mins and, in some situations, get financing in as little as 24 to 48 hours after loan approval. When comparing personal fundings online or off, pay close focus to the information.

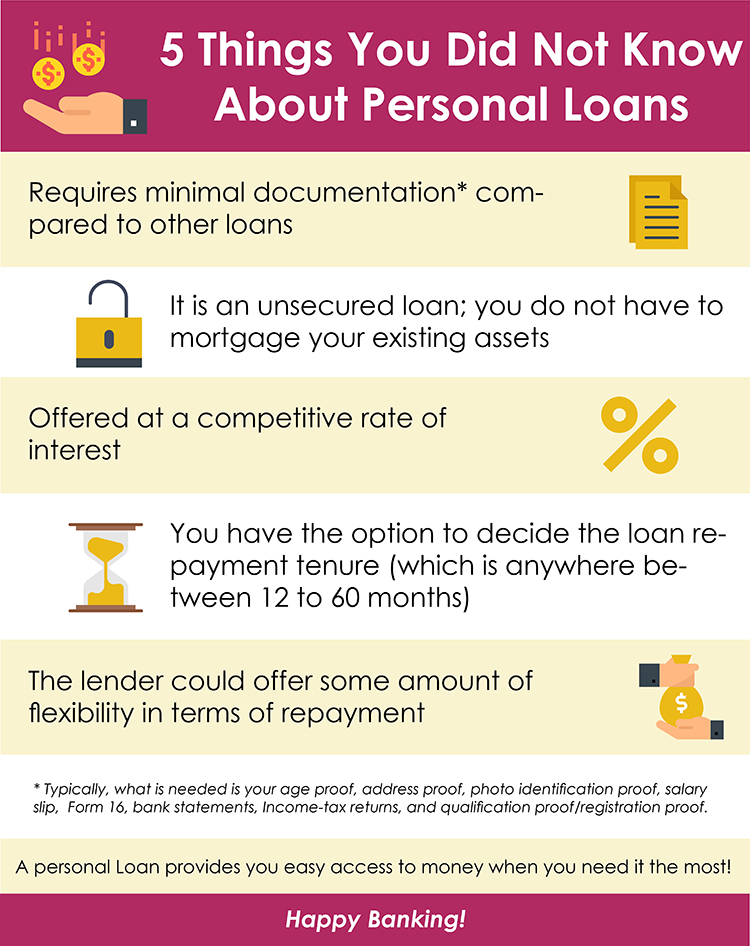

It's likewise handy to inspect the minimum demands to receive an individual financing. Lenders can have various needs when it involves the credit rating rating, income, and debt-to-income proportion that are appropriate to be approved for an individual financing. This can aid you narrow down the financings that may best fit your debt and monetary account.

It generally features a greater rate of interest and a cost. Individual loans usually have longer terms and lower rates of interest than cash loan fundings. Each lender has various terms for their loans, consisting of needs for approval. To enhance your probability of getting a funding, you can function to enhance your credit history and economic standing, partly by decreasing your financial debt.

A personal funding can consist of fees such as source costs, which are included to the total expense of the funding. The broad selection of individual fundings presently readily available makes it virtually a warranty that there's an offer out there suited to your economic needs.

An Unbiased View of Personal Loans copyright

Consequently, it's critical to meticulously study and contrast different lenders and finance products. By making the effort to find the ideal feasible car loan, you can keep your regular monthly settlement low while also lowering your risk of default.

You might likewise utilize them to settle various other financial debts with higher rates of interest. The majority of individual financings vary from $100 to $50,000 with a term between 6 and 60 months. Personal lendings are readily available from loan providers, such as banks and credit unions. Your lending institution might use you a lending for even more than what you need.

Your credit scores report, credit history and financial debts might impact your funding visit homepage choices. For instance, the rates of interest and sort of financing you receive. Lenders typically offer you the cash for your finance in among the following methods: in money transferred in your savings account sent to you as an electronic transfer sent out to various other loan providers directly (if you're combining other financial obligations) on a pre paid card There might be a cost to turn on and use a prepaid card.

The Personal Loans copyright Diaries

Get in touch with your rural or territorial Consumer Matters office to get more information about providing rules. There are 2 types of personal finances, safeguarded financings and unsafe finances. A protected individual funding makes use of an asset, such as your automobile, as a security. It's a pledge to your lending institution that you'll repay the finance.

There are different kinds of guaranteed loans, consisting of: protected personal fundings title car loans pawn lendings An unsafe personal finance is a financing that does not need collateral. Obtaining money with an individual lending might set you back a great deal of cash.

When you take out a personal loan, your lender provides you a quote for your routine settlement amount. To obtain to this quantity, they calculate the overall cost of the financing. They split Continue this quantity by the number of settlements based on the length of the term. The complete price of the finance includes: the amount of the lending the passion on the funding any kind of various other applicable fees Ensure you understand the total price of a lending prior to making a decision.

The 9-Second Trick For Personal Loans copyright

Expect you desire to obtain an my company individual finance for $2,000. The rates of interest is 19.99% on a monthly layaway plan. The instance listed below shows the complete expense of a finance with various terms. This example reveals that the longer you take to pay off your lending, the much more costly it'll be.

Report this page